Tax-Free Childcare Calculator

Savings

Upto 20%

Working Hours

Parents must work minimum 16 hours

Income

Less than £100,000

(Both Parents)

Out of Work

Eligible if starting work within 31 days of application

Age

Children under 12 or 17 (disable child only)

For Citizens Of

England

Scotland

Wales

Northern Ireland

Childminder

Must be registered with Government authorities like Ofsted

Contributions

Receive up to £500 every 3 months (up to £2000 per year)

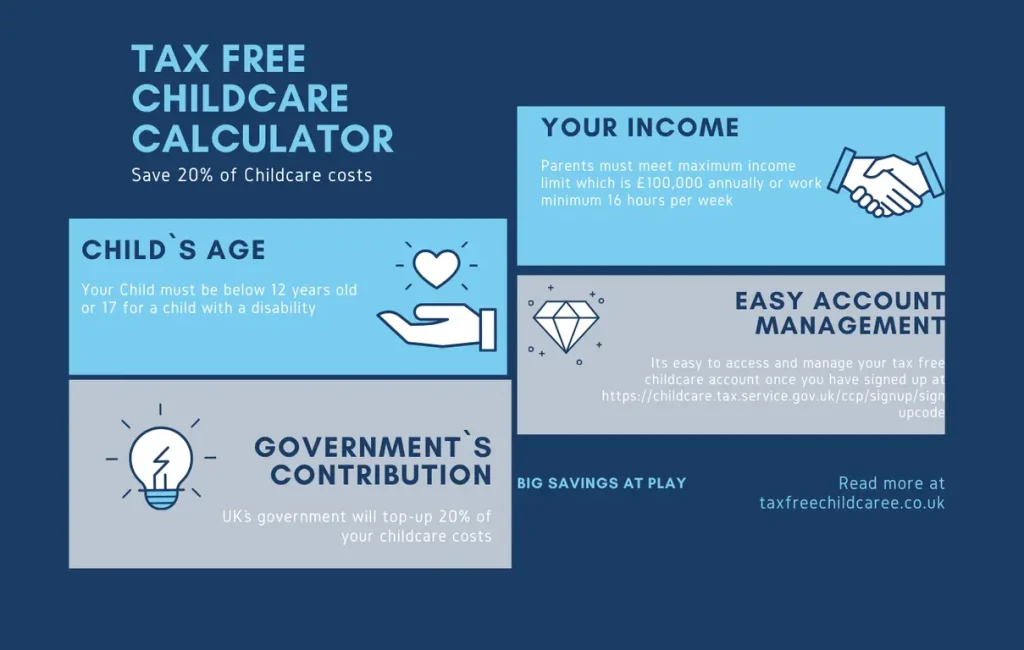

Tax Free Childcare Calculator lets parents find out the payouts they are required to pay into their kids childcare accounts and the 20% top up amount which will be contributed by the government of UK. This is an essential tool in helping parents work out details about the payout without the hassle of manual calculations.

Tax Free Childcare

Tax Free Childcare support is an excellent initiative by the UK government, which facilitates working parents in taking 20% off their childcare costs. For every £8 a parent or grandparent adds into a child`s online childcare account, the government will add £2 with a max ceiling of £2000 or £4000 if the child has some disability.

This scheme is available across England, Scotland, Wales, and Northern Ireland for childcare services which are approved by the government .

What you can use Tax-Free Childcare for

You can use Tax Free Childcare to pay for:

- Nurseries, Childminders, and ninnies which are registered with the government

- Breakfast, after school and holiday clubs.

- Specialist equipment can also be procured with this childcare for disabled children. Equipment may include mobility aids etc.

- Advance costs, deposits, retainers and extras like lunches and trips if these are part of overall costs.

Eligibility

If you are working

You will be considered eligible if:

- You`re employed or self-employed

- Earning at least minimum wage for 16 hours weekly which is £2,379 if you`re 21 years and plus, £1788 if you are 18-20 years old and £1331 if you are under 18 or an apprentice.

- Self-employed parents with a business under 12 months old can apply.

If you’re not currently working

- No worries if you are not currently working or out of work on a temporary basis. You may qualify for the scheme if you are on sick, annual, maternity, paternity or adoption leave and would return to work within the next 31 days.

- You are also eligible if your partner works and you are receiving incapacity benefits, severe disablement allowance, carer’s allowance, employment, or support allowance.

Your income

You should be mindful of maximum and minimum limit cap on your earnings to qualify for the scheme. You will be ineligible if you are or your partner earns: -

- None of the parent`s income should exceed £ 100,000 annually. However combined income of both parents may exceed £ 100,000 annually. This maximum cap excludes dividends, interest, property income or personal pensions.

- Those parents who earn less than the minimum wage also do not qualify for this scheme. To check if your income is eligible for this scheme or not please consult Government officials.

Your child

There is a certain age limit for children to qualify, for example

- The child must be 11 or under until the 1st of September after their 11th birthday.

- Should be living with parents.

- However disabled children can be 16 or below to continue receiving the benefits until 1st September after their 16th birthday.

Your immigration status

Immigration or nationality status of parents have a certain role to be eligible. You are eligible if: -

- You are a British or Irish citizen or

- Have a settled or pre settled status with access to public funds or

- Frontier workers who live abroad but began working in the UK before January 1st, 2021, may qualify if hold a permit.

If your child is disabled

Some kids have a disability, and there’s money to help them out until they’re 16. They can get up to 4,000 pounds a year if they are getting special help like Disability living allowance or Personal independence payment, or if they are blind or can’t see well. This money can help them with things like rides or special stuff they need every day.

If you get tax credits, Universal Credit, or childcare vouchers.

Tax Free childcare cannot be used with Tax Credits, Universal credits, or childcare vouchers, however 15 hours and 30 hours free childcare can be used with this scheme.

If you have a partner

Both parents must meet work and income criteria and may apply jointly. There is no cap if the joint income of both parents exceeds £100,000, however, if one parent`s income exceeds, or work hours drop below the minimum income cap, the household becomes ineligible for the scheme.

If you are separated

If parents are separated and share the custody of the child, then it is up to HMRC to decide who can claim the benefits or support for the child. It boils down to a simple rule: HMRC bases the eligibility on who the child lives with most of the time, or parents may jointly decide who will receive the childcare if they divide 50/50 custody. However, it should be remembered that only one parent can claim childcare at a time per child.

Application process: step by step

Apply online at Gov.uk for Tax-Free Childcare. The process is simple and straight forward and must not take more than half an hour of your time.

What you will need:

- Your National Insurance number and, if self-employed, your Unique Taxpayer Reference (UTR).

- Details of your children, including their UK birth certificates reference numbers.

- Information about your income and employment.

Steps to Apply:

- Check eligibility on the above-mentioned Government website.

- Use the childcare calculator to see which is the best option for you as per your circumstances (Childcare Calculator).

- Complete the online application, which may also cover free childcare (15 or 30 hours) if you are qualified.

- Sign in to your childcare account to pay your childcare provider, with funds clearing within 24 hours.

- This step is very important you must reconfirm your details after every 3 months to continue receiving support.

Important Notes:

- If you are on tax credits, these will stop immediately upon approval, and you must cancel Universal Credit and childcare vouchers.

- The service is available in Welsh (Welsh Service).

- You can use the scheme alongside free childcare hours if eligible, making it flexible for working families.

Childcare Costs In UK in 2025

According to Carom Family and Childcare`s 24th annual childcare survey – a popular UK based organization dedicated to improving family well-being through research and advocacy, the childcare costs have seen notable changes: -

Part-time Childcare Costs:

A part-time nursery taking care of a child under two may cost £ 70.51 per week for 25 hours per week, in England reflecting a 56% decrease from 2024 which is a great sign.

Full-time Childcare Costs:

A full-time nursery taking care of a child under two may cost an average of £238.95 per week, while taking care of a child for 50 hours per week. This marks a 22% decrease compared to the last year.

After-School Clubs:

The average weekly cost for after school clubs is $72.79, totaling an approximate $2,839 during term time.

Is there any help with childcare costs?

Tax Free Childcare:

Eligible working families can receive a 20% contribution towards childcare costs. For every £8 deposited into a Tax-Free Childcare account, the government adds £2, up to a maximum of £2,000 per child annually, or £4,000 for disabled children.

Universal Credit:

Eligible families can claim up to 85% of childcare costs, providing substantial relief for low to middle-income households.

Free Childcare Hours:

In England, working parents of three and four-year-olds can access 30 hours of free childcare per week during term time.

These initiatives aim to make childcare more affordable, enabling parents to balance work and family responsibilities effectively.

Pros and Cons of the Tax Free Childcare Scheme

The Tax Free Childcare Scheme offers a valuable financial help to working parents but it comes with certain limitations. Below are some of the pros and cons of the scheme to help you make a better decision.

What Are the Benefits?

The scheme offers some valuable benefits for the parents like: -

- Significant Savings: Parents can receive up to £2,000 per child per year (or £4,000 for disabled children) through the government’s 20% top-ups.

- Flexible Use: Funds can be used for a wide range of childcare services, including nurseries, childminders, after-school clubs, and even holiday camps.

- Works Alongside Free Childcare Hours: You can still benefit from 15 or 30 hours of free childcare, depending if you are eligible.

- Open to All Children Under 11: Unlike some other childcare support schemes, which are restricted to younger children, the Tax-Free Childcare scheme covers the children up to age 11 (or up to 16 if they have a disability). This broader age range makes it a suitable option for parents of school-aged children needing extended care, which is a huge plus for this scheme.

What Are the Downsides of Tax Free Childcare?

Though this scheme comes with numerous benefits, there are some drawbacks as well for parents to consider.

It Isn’t Truly “Tax-Free” Childcare

Despite its name, this scheme does not provide a tax exemption or direct relief on childcare costs. Instead:

- Parents must deposit 80% of the childcare fee, and the government adds 20% as a top-up.

- You are still paying a significant portion of the costs, which may not be as beneficial as other support programs like Universal Credit.

Incompatibility With Other Schemes

One of the biggest disadvantages of Tax-Free Childcare is its exclusivity—it cannot be used alongside other government childcare support programs:

- Childcare Vouchers: Although this was a great scheme, parents who had opted for it before 2018 can still use it until they voluntarily drop it or change their employer. However, it is close to new applicants, and it cannot be used alongside Tax Free Childcare support. So, parents, if eligible, must choose one of them at a time.

- Tax Credits & Universal Credit: It cannot be used with Tax Credits or Universal credits. If you apply to any of them all of the benefits of these two schemes will stop automatically. Given the advantage of Universal Credit covering 80% of childcare costs should be given due thought before shifting to Tax free childcare support. So you must weigh your own circumstances before making a decision.

Contribution Limits

Although the scheme provides financial relief, it is capped per quarter:

- The maximum top-up is £500 every three months (£1,000 if the child is disabled).

- For families with high childcare costs, this limit may not be enough to fully offset expenses.

Combining Tax-Free Childcare With Other Schemes

Since Tax-Free Childcare is not compatible with many government`s childcare support programs, understanding how it compares to other schemes is crucial for parents to make an informed decision for themselves.

Childcare Vouchers

- Not compatible with Tax-Free Childcare.

- The Childcare Voucher scheme closed to new applicants in 2018, but parents who were already enrolled can continue using it.

- Parents should compare their savings before switching, as some may benefit more from staying on vouchers.

Tax Credits

- Cannot be used alongside Tax-Free Childcare.

- Applying for Tax-Free Childcare immediately cancels Tax Credits, so switching should be carefully considered.

Universal Credit

- Not compatible with Tax-Free Childcare.

- Universal Credit covers up to 85% of childcare costs, making it more beneficial for some low-income families than the 20% top-up provided by Tax-Free Childcare.

15 Hours and 30 Hours Free Childcare

- Can be used together with Tax-Free Childcare.

- Parents eligible for 15 hours or 30 hours of free childcare can use Tax-Free Childcare for additional hours or wraparound care.

Tax-Free Childcare - eight need-to-knows

- Government funded top-ups up to £2,000/child (£4,000 if disabled).

- For workers, including self-employed.

- Kids must be 11 or under (16 if disabled).

- Minimum earnings apply; max £100,000/year.

- Reconfirm every 3 months.

- Incompatible with most of other benefits.

- Can be used for approved childcare only.

- Check alternatives first.

Tax-Free Childcare is Best Only If You Can't Get Other State Help – Check Eligibility First

You must know that there are various state sponsored childcare support schemes like Free Nursery hours and Universal credit support etc. Each scheme has its own benefits, so one must do all its research and then make an informed decision

‘Free’ Nursery Hours for Three- to Four-Year-Olds – and Some Younger Children Too

- England: 3-4-year-olds receive 15 or 30 hours of free childcare.

- From September 2024: 9-month-olds are now eligible for 15 hours per week.

Universal Credit (or Tax Credits) May Cover Some of Your Childcare Costs

- Universal Credit covers up to 85% of childcare costs, often providing more financial support than Tax-Free Childcare.

- Warning: If you’re claiming Universal Credit or Tax Credits, switching to Tax-Free Childcare will immediately stop all benefits—use the childcare calculator before deciding.

Tax-Free Childcare vs. Childcare Vouchers – Which is Better?

Tax-Free Childcare Wins for...

- Higher earners (£50,000+).

- Flexibility across multiple childcare providers.

- Self-employed individuals (who can't access vouchers).

- Up to £2,000/year per child (£4,000 if disabled).

Childcare Vouchers Win for...

- Lower earners (£30,000 or less) with stable childcare costs.

- If your employer still offers vouchers (closed to new applicants).

- Families with only one working parent (Tax-Free Childcare requires both parents to work unless one is disabled or a carer).

How to Check If Your Provider Is Registered?

Finding a Registered Provider

- Use the Gov.uk childcare provider tool.

- Ask providers directly if they accept Tax-Free Childcare payments.

What If Your Provider Is in the EEA?

Not applicable, the scheme is UK-only

Support from the UK’s National Charity for Working Parents

The charity Working Families provides free advice on childcare options and financial support.

Government-Funded Childcare is Available for All Ages

From September 2024, 9-month-olds can receive 15 hours of free childcare per week.

‘Free’ Childcare for Three- and Four-Year-Olds (and Some Younger Children)

England, Scotland, Wales & Northern Ireland offer 15-30 hours for 3-4-year-olds.

How Government-Funded Childcare Works Across the UK

England

- Parents can claim 15 hour free childcare for children above 9 months old up to 2 years old.

- The entitlement increases to 30 hours per week for eligible working parents of children aged 9 months up to school age

Wales:

- All 3- and 4-year-olds are entitled to a minimum of 10 hours per week of publicly funded nursery education.

- Depending on parental economic and employment status, children in this age group may be eligible for up to 20 additional hours of state subsidized childcare each week.

Scotland:

- All 3- and 4-year-olds, and eligible 2-year-olds, can access up to 1,140 hours per year (approximately 30 hours per week during term time) of funded early learning and childcare.

- Additional support may be available for low-income families, including discretionary funding for 2-year-olds.

Northern Ireland:

The Pre School Education Program offers 12.5 hours per week of funded pre-school education for children in their immediate pre school year (typically aged 3-4).